San Diego Home Insurance Fundamentals Explained

San Diego Home Insurance Fundamentals Explained

Blog Article

Safeguard Your Home and Loved Ones With Affordable Home Insurance Coverage Plans

Importance of Affordable Home Insurance Coverage

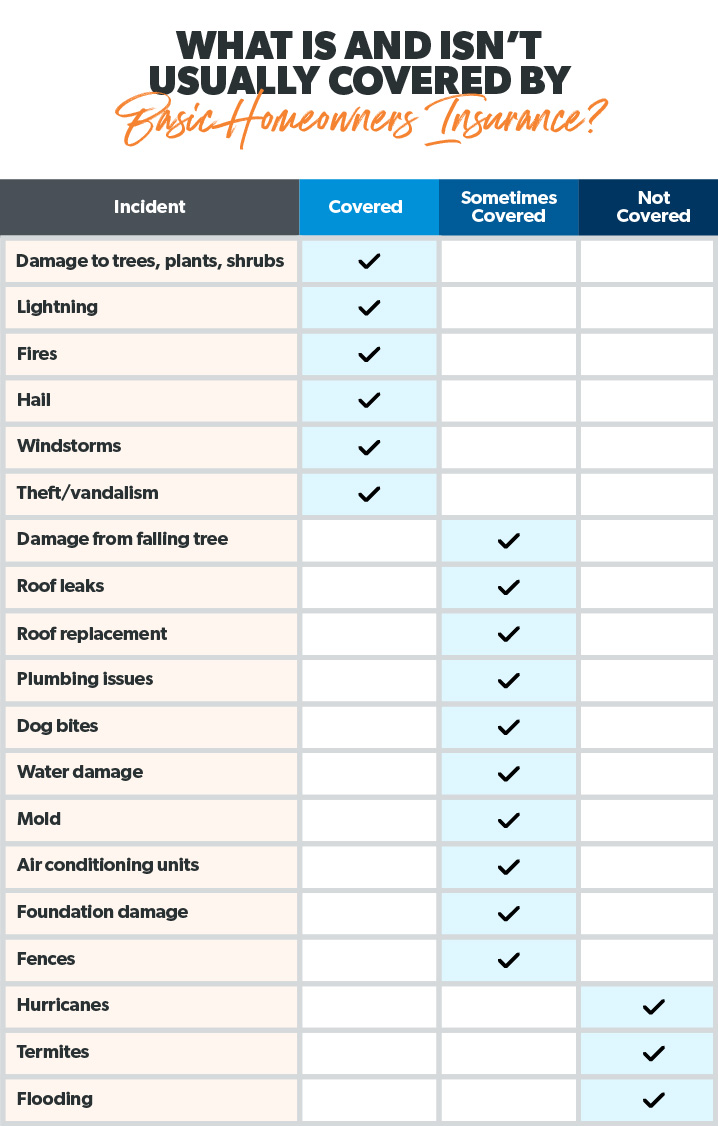

Safeguarding affordable home insurance coverage is essential for safeguarding one's residential or commercial property and economic wellness. Home insurance supplies protection against numerous dangers such as fire, theft, natural catastrophes, and individual responsibility. By having a comprehensive insurance policy strategy in place, homeowners can relax assured that their most considerable financial investment is shielded in the occasion of unanticipated circumstances.

Budget friendly home insurance policy not only supplies financial safety but additionally provides comfort (San Diego Home Insurance). In the face of increasing residential property values and construction costs, having a cost-efficient insurance plan ensures that property owners can conveniently rebuild or fix their homes without facing considerable monetary worries

Additionally, affordable home insurance can additionally cover individual items within the home, providing repayment for items harmed or taken. This insurance coverage expands beyond the physical structure of your home, securing the contents that make a residence a home.

Coverage Options and Purviews

When it comes to coverage limits, it's important to understand the optimum amount your policy will certainly pay for each and every kind of protection. These restrictions can vary relying on the policy and insurer, so it's necessary to review them carefully to ensure you have adequate protection for your home and properties. By comprehending the insurance coverage options and restrictions of your home insurance plan, you can make enlightened choices to safeguard your home and liked ones successfully.

Aspects Affecting Insurance Coverage Costs

A number of variables significantly affect the costs of home insurance policy plans. The area of your home plays a critical duty in identifying the insurance premium. Houses in areas vulnerable to all-natural calamities or with high crime rates normally have higher insurance expenses because of increased risks. The age and problem of your home are likewise elements that insurance companies take into consideration. Older homes or properties in poor problem may be much more expensive to guarantee as they are a lot more susceptible to damages.

In addition, the type of coverage you select straight affects the cost of your insurance policy. Choosing for added coverage options such as flood insurance or earthquake protection will enhance your premium.

Additionally, your credit rating score, declares history, and the insurer you choose can all influence the cost of your home insurance policy. By taking into consideration these elements, you can make informed Get More Information choices to aid handle your insurance costs properly.

Contrasting Suppliers and quotes

Along with comparing quotes, it is crucial to evaluate the track record and economic stability of the insurance policy service providers. Search for client reviews, scores from independent firms, and any kind of background of grievances or regulative actions. A dependable insurance coverage copyright need to have a good track record of immediately refining cases and offering outstanding client service.

Furthermore, think about the specific protection functions offered by each supplier. Some insurance firms might offer extra benefits such as identity theft protection, devices breakdown insurance coverage, or protection for high-value products. By thoroughly comparing companies and quotes, you can make an educated choice and choose the home insurance coverage strategy that finest fulfills your demands.

Tips for Saving Money On Home Insurance

After extensively comparing carriers and quotes to find the most ideal coverage for your needs and budget plan, it is prudent to explore reliable techniques for saving on home insurance. Numerous insurance companies offer discount rates if you acquire numerous plans from them, such as combining your home and auto insurance coverage. Frequently assessing and updating your plan to mirror any type of adjustments in your home or conditions can guarantee you are not paying for protection you no longer requirement, assisting you save money on your home insurance policy costs.

Final Thought

In final thought, securing your home and liked ones with budget-friendly home insurance policy is essential. Executing suggestions for conserving on home insurance policy can also assist you protect the necessary protection for your home without breaking the bank.

By unraveling the intricacies of home insurance coverage strategies and exploring functional approaches for securing budget-friendly insurance coverage, you can ensure that your home and liked ones are well-protected.

Home insurance policy plans usually supply a number of coverage alternatives to protect your home and possessions - San Diego Home Insurance. By recognizing the coverage options and limits of your home insurance policy, you can make enlightened choices to guard your home and liked ones successfully

Frequently examining and updating your plan to show any kind of adjustments in your home or situations can guarantee you are link not paying for insurance coverage you no longer requirement, aiding you save money on your home insurance costs.

In verdict, protecting your home and loved ones with budget friendly home insurance is essential.

Report this page